At a recent birthday party, I remember talking to an old classmate about how school was so different in our days. Our parents would compare SSC and CBSE and whether we would attend IIT or a private college. Nowadays, we consider ICSE or IB (International Baccalaureate) and whether our children will go to the US, UK or Canada for university.

Every parent wants their child to have the best of everything. As parents we worry about every little need of our children. Their education and wedding are two of the biggest concerns we have.

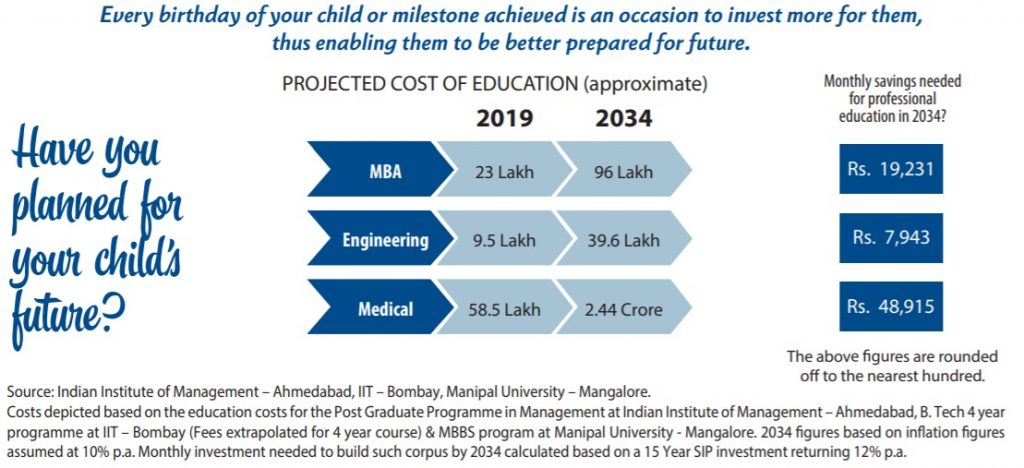

When the time arrives, what would you prefer your child considers when choosing a higher education course? The cost of the degree or his/her interest in it.

Naturally, the second option. When anyone is passionate about what they study, they excel in that field often setting new benchmarks. Sadly, the cost of the programme often ends up influencing the choice of higher education for many. The solution is clear: by planning and investing NOW. If this seems like an oft-repeated phrase, that is because it is the most effective means to the goal.

As Indian parents, we have the unique expenditure of our children’s wedding expenses.

This essentially means saving up simultaneously for education and wedding and fervently hoping some money will last for retirement after all this!

In such a situation, here are some options that parents should consider: Use the right saving instruments. An FD alone cannot pay for university. You need a combination of higher risk instruments and steady ones like Sukanya Samriddhi (for a girl child) to balance the equation.

When you choose your investments, make sure you choose those that have liquidity and can be exited if performance is below expectation. Products like mutual funds, or even direct equities (if you track the market) are transparent options than no lock-ins.

To conclude, a combination of term insurance and mutual funds will give you the best results when it comes to planning for your child’s education.

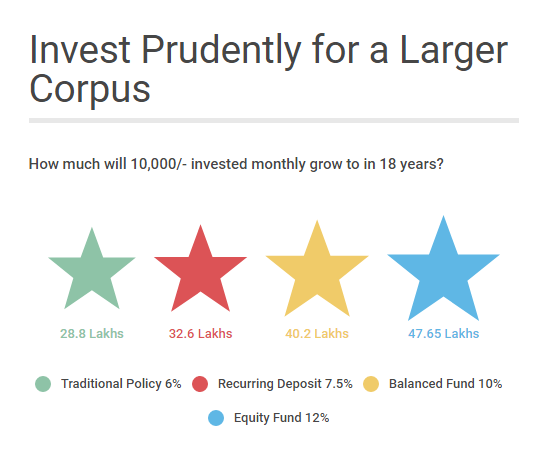

Investing in an equity fund will give you high returns in the long term, helping you build the corpus over the years. And a term plan is an inexpensive way to secure the family’s future in case something untoward happens to the breadwinner.

Wow, that’s what I was exploring for, what a information! present here at this weblog, thanks admin of this web site.